Chain transactions are complicated. Every aspect of them can change how they’re treated for VAT purposes. It’s always worth talking to an expert about your VAT obligations, but when it comes to chain transactions, it’s pretty much a requirement.

In this article, I’m going to explain the basics. I’ll give you common examples and how tell you how things get complicated, so you know what to expect when engaging in chain transactions.

What’s a Chain Transaction?

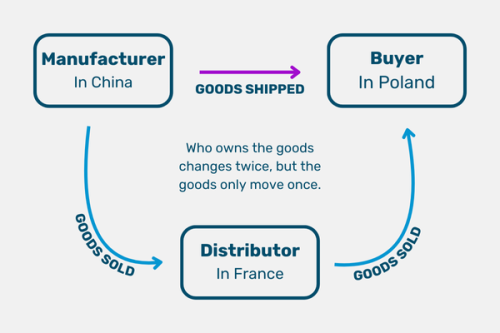

A chain transaction is when the ownership of goods changes between several businesses, whilst the goods themselves are just sent from the first supplier in the chain to the final buyer. For example, a Polish customer orders something from your online store based in France. You have the manufacturer ship the product from their factory in China directly to the customer.

A chain transaction example involving three entities

Chain transactions involve at least three entities (though often there are more) and the goods change ownership at each step in the chain.

Chain Transactions in the EU

In 2020, the EU published rules for chain transactions. The rules clarified who in the chain got to take advantage of the 0% rated intra-community supply of goods (I’ll explain that a bit later). First, the rules establish what transactions qualify as chain transactions. There is a list of conditions:

- The ownership of the goods must change hands multiple times, but only be transported across the border between two EU countries once

- The goods must be transported across the border between two EU countries

- The goods have to be transported from the first supplier to the final buyer in the chain

- The goods have to be transported by the “intermediary operator” or by a third party on their behalf

The “intermediary operator” is one of the entities in the chain. They either transport the goods themselves or pay another company to do it for them.

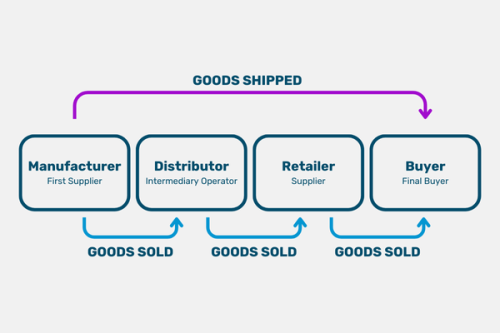

A chain transaction example showing which party is the intermediary operator

If the requirements are met, then in accordance with Article 36a (1) of the EU VAT Directive “the dispatch or transport of the goods is ascribed to the supply made to the intermediary operator”. That means the entity that transports the goods (or arranges it) is the intermediary operator. They get to take advantage of the 0% rated intra–community supply of goods.

Dropshipping

Dropshipping is an ecommerce model where the goods are shipped directly to the customer from the manufacturer. Print-on-demand is a common example, with Printify being a big name in the space.

Dropshipping is a chain transaction for VAT purposes. How VAT applies to the transaction depends on where the goods are at the point of sale and where the customer is.

In cases where the seller, manufacturer and customer are all in the same country, the VAT on dropshipping is relatively straightforward. It gets complicated when the goods are in another country. If your goods are outside the EU at the point of sale or your customer is based outside the EU, they won’t qualify for the 0% rated intra-community supply of goods.

Every EU Member State has a lot of control over how they apply VAT rules. How VAT applies to your dropshipping set-up depends on the circumstances of each transaction. I really recommend you get advice before you start making sales.

Intra-Community Supplies and Acquisitions

In the EU, how VAT applies to a transaction depends on what role you play in it. This is often called your “perspective”. The seller and the buyer have different perspectives on a transaction. There are two perspectives to consider when goods are moved across the border between two EU countries: intra-community supply of goods and intra-community acquisition of goods.

Working out your perspective is important, as it impacts how you handle the VAT. Intra-community supplies of goods are zero-rated if the buyer has provided the seller with a valid VAT number. That means you don’t have to charge them VAT on your supply. If you’re making an intra-community acquisition of goods, then you’ll self-account for the VAT using the reverse charge mechanism.

Goods are supplied (rather than acquired) when you are the seller, and you transport the goods across the border between two EU countries. Acquisitions are when you are the buyer, and you receive goods across a border.

In a chain transaction, working out who is making the intra-community supply of goods (and therefore the intermediary operator) can be incredibly complicated. Only one transaction in the chain can be the intra-community supply of goods.

Transport of Goods

The intra-community supply of goods in a chain transaction has to be a “single transport”. That doesn’t necessarily mean one mode of transport or that goods have to make it to their end destination all in one go. For example, a single transport can be the goods leaving a factory in a truck, transferred to a ship and transferred again into another truck.

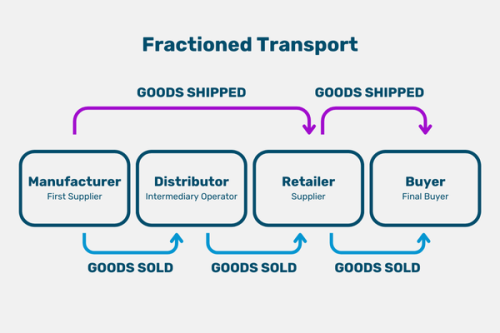

A single transport is instead a “single operation” that goes from the first supplier to the end buyer. If the intention of the transport isn’t to deliver the goods to the end buyer, then it doesn’t count. Multiple instances of transport break the chain and is called “fractioned transport”. Fractioned transport makes things more complicated again.

A chain transaction example showing fractioned transport

The final buyers and first suppliers can arrange the transport. As they can’t be the intermediary operator, the chain transaction rule can’t apply if they arrange their own transport. However, first suppliers can arrange transport on behalf of the intermediary operator.

The Intermediary Operator

Before you can decide which transaction in the chain is the intra-community supply of goods, you have to determine who the intermediary operator is. They’re the most important part of the chain as the rules only apply when they transport the goods (or hire someone to do it for them).

Intermediary operators have to be registered for VAT in the EU country where the goods are transported from. They need to communicate their VAT number to their supplier. There aren’t any particular rules for how this communication should happen. You could just email it or include it on the invoices.

The first and last people in the chain can’t be the intermediary operator. To prove that you’re the intermediary operator, you’ll need to have evidence that you transported the goods or arranged for someone to do it on your behalf. Things like order documents, invoices from suppliers and warehouse receipts will work as evidence. You should also keep any details you have on the means of transport, like flight numbers and ship details.

Every EU state interprets when an entity in a chain transaction becomes the intermediary operator differently. This is a problem that opens the system up to fraud and makes it incredibly difficult to determine when VAT applies and who has to pay it.

The Chain Transaction Simplification: Triangulation

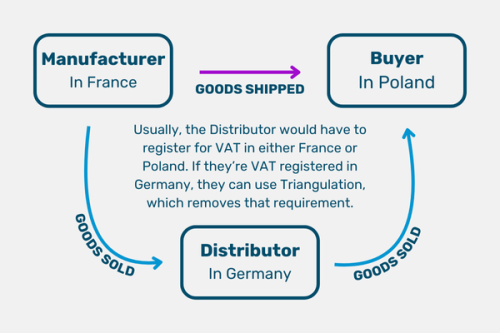

The EU VAT Directive includes a simplification for chain transactions involving three parties: Triangulation. Put simply, Triangulation releases the second business in the chain from having to register for VAT in the EU countries where the first and last companies are based.

An example of triangulation

The use of Triangulation has specific requirements:

- – Every business involved has to be in a different EU Member State

- – Every business involved has to be VAT-registered

- – There can only be three entities and two supplies of goods

In addition, Triangulation rules can change in each Member State. Some don’t allow the simplification if one of the suppliers is registered in the Member State of another party to the transaction. Some EU countries will let you apply Triangulation to transactions with four or more parties. And of course, things get even more complicated when one or more of the parties, or the goods are located outside of the EU. One thing that remains consistent is that you can’t use triangulation unless every invoice in the chain is issued correctly.

This article was originally published 21/08/2021 and has been updated for comprehensiveness.