Shopify VAT: A Guide to Compliantly Selling Cross-Border

If you’re selling online with Shopify, we’ve compiled the ultimate guide to keeping your Shopify store VAT compliant in 2025.

Shopify today is one of the most popular ecommerce platforms. Inspired by poor experiences shopping for snowboarding gear online, three Canadians created Shopify in 2004. The platform has gone from strength to strength, doubling its number of online merchants each year. Shopify in 2025 has over 5 million active stores currently operating.

Getting your Shopify store online is exciting so it’s easy to overlook the complicated (but necessary) parts of international ecommerce. For EU and non-EU sellers who use Shopify to reach EU customers, it’s crucial to understand VAT and its impact on your business.

How to handle VAT as a Shopify seller

Here we’ll discuss the VAT implications you may need to consider when selling on your website through Shopify and what next steps you can take to stay compliant.

Charging customers VAT via location

Since the July 2021 EU VAT reforms, the general taxation rules have changed. Sellers will likely need to charge VAT based on the location of their customers. This will directly affect you if you sell through your own website with Shopify. You’ll need to charge the correct rate of VAT for every sale made to EU customers.

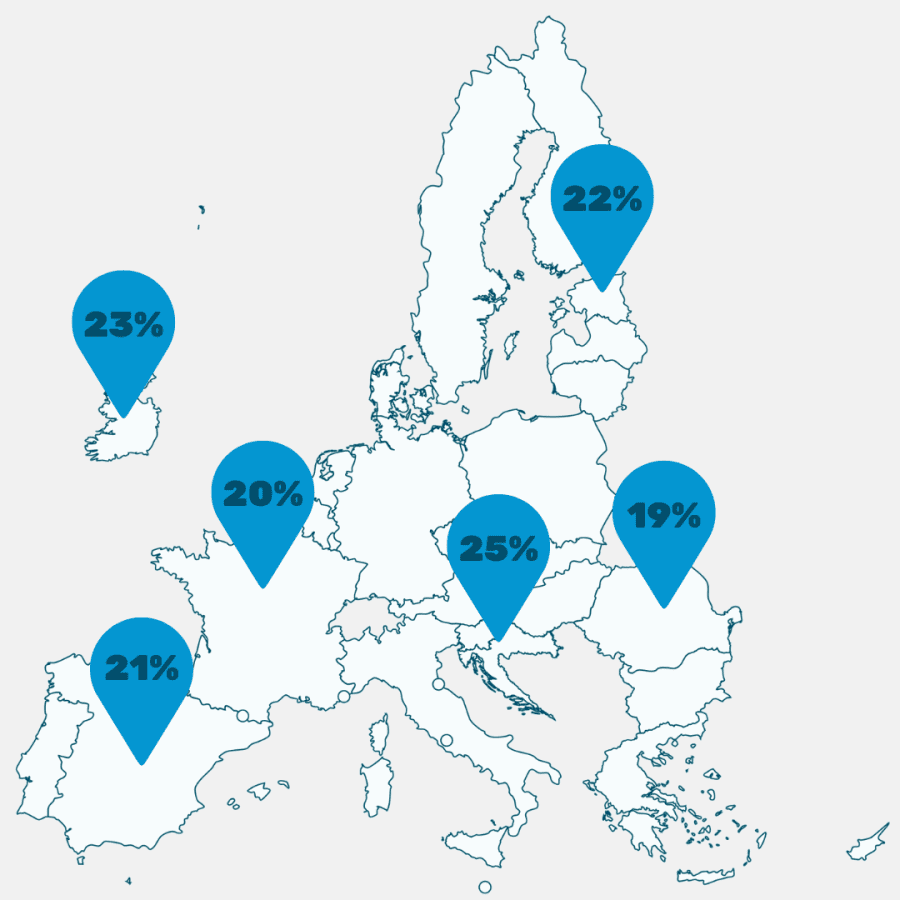

VAT rates differ throughout the EU, ranging between 17-27%. Staying updated and aware of the VAT rates you require is important to keep your margins protected. Want to find out more about VAT across the EU? Check out EU VAT Numbers 101 to find out everything you need to know about EU VAT.

EU-based businesses

For EU-based businesses that sell through Shopify, a local VAT registration will be required in any country where you hold stock. Storing inventory in an EU country for onward sale creates a taxable supply and as a result, triggers this obligation.

Micro-business threshold

For ‘micro’ EU-based businesses whose EU-wide (excluding their home country) taxable turnover per calendar year remains below EUR 10,000, VAT registration may only be required in your country of residence. This means you will only need to charge the VAT rate of the EU member state where you are established.

As this micro-business exemption is relatively low, most EU-based Shopify sellers will quickly surpass this threshold. This will mean that VAT should be charged based on the location of your customers. You’ll need to register for VAT in every country where you have customers or for One Stop Shop (OSS).

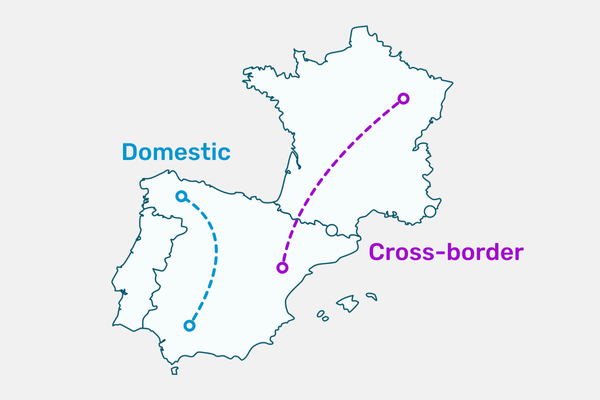

Selling domestically versus cross-border

For these VAT-registered businesses, any domestic sales made in their home country would be reported via their local VAT registration. For example, you’re a Shopify seller based in France. When you sell goods to French customers, you report the VAT due on these sales on your French VAT return.

If, however, you’re selling to customers in other EU member states, this would be deemed cross-border trade. You would need to register for VAT in the countries where your customers are based. Businesses selling cross-border through Shopify need a VAT registration in these locations from the first sale.

EU-based businesses selling cross-border through a Shopify website can register for Union OSS in their country of establishment. Through that Union OSS registration, you can report all intra-EU sales to EU consumers. This option reduces the cost and time required to VAT register in each country where your customers are located.

Non-EU based businesses

Most non-EU businesses distance selling imported goods to EU customers via Shopify will need to register for VAT in the countries where their customers are located.

Holding stock within the EU and outside of the EU

If your business is established outside of the EU but you hold stock within an EU member state for onward sale, you will still be required to VAT register in the country(s) where your stock is held. This registration will also mean you can reclaim any import VAT paid to transport your inventory into the country. Although stock can be held in the EU by a non-EU seller, the micro-business threshold will not apply here. You can then register for the OSS scheme to declare any intra-EU cross-border B2C transactions.

If your business is established outside of the EU and you don’t hold stock within the EU, you will need to pay VAT on all consignments imported to EU customers. Previously goods imported with a value under EUR 22 were exempt from VAT, but this has now been abolished.

If you are a non-EU business selling to EU customers via your Shopify website, you may benefit from the IOSS scheme. Under IOSS you can account for the VAT due on your distance sales of imported goods if the intrinsic value of each consignment remains below EUR 150. As a non-EU Shopify seller, you will need to apply VAT to every order taken from EU customers. IOSS can significantly lighten the administrative burden that VAT processes impose so instead you can focus on growing your online store.

Nominating the Importer of Record

If you sell goods in consignments that exceed the value of EUR 150 on your Shopify store, you’ll need to nominate an Importer of Record to cover the import VAT and potential duties at customs. Most commonly the business would take on this role, to relieve the customer of any unexpected fees or complicated processes.

If you, the business, decide to be the Importer of Record for the goods, you will need to remit import VAT to the tax authorities in the EU Member State of importation. You will also need to register for VAT in that member state to recoup the import VAT paid on your periodic VAT return. You would then need to account for the transfer of goods on your local VAT return (providing the customer is in the same EU member state as your goods) or via an OSS registration (if the customer is in a different EU member state as your goods).

How to Collect VAT through Shopify

Where and when you will need to register for VAT will depend on where your business is established and the value of the supplies you sell through your website. For most companies, VAT will likely be due where you hold stock and where your customers are located.

As any business commonly wants to reach as many customers as possible, this opens them up to multiple VAT registrations that can be difficult to manage and expensive to set up. The OSS and IOSS schemes are designed to relieve both EU and non-EU businesses of excessive VAT processes, simplifying cross-border sales to a single registration and a monthly or quarterly VAT return.

To set up VAT collection on your Shopify website follow these instructions:

Steps:

From the Shopify admin, go to Settings > Taxes.

In the Tax regions section, beside European Union, click Set up.

In the VAT on sales within the EU section, click Collect VAT.

Select a country in which you are registered.

In VAT number, enter your VAT number.

Click Collect VAT.

Optional: To add more regions and account numbers, click Collect VAT.