Amazon FBA Europe is an easy way to expand your ecommerce business into Europe. Amazon stores your goods in their fulfilment centres across Europe and ships your orders. Your products can qualify for Prime, so your customers get speedy delivery at a lower cost to your business.

The biggest benefit of selling through Amazon FBA in the EU is access to Amazon’s European customer base. Germany alone generated 37.6 billion US Dollars in net sales in 2023, making the country Amazon’s second-largest market.

What is Amazon FBA Europe?

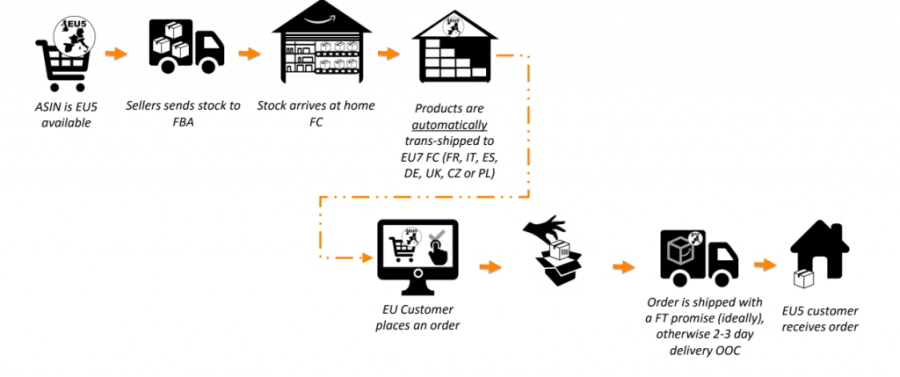

The full name of the programme is Pan-European Fulfilment by Amazon. For a fee, Amazon will distribute your inventory across their fulfilment centres in the EU and ship your orders to customers from those centres. This allows you to easily sell your goods across all of Amazon’s EU storefronts.

What countries does Amazon Pan-EU FBA apply to?

Pan-European FBA is available for eight Amazon stores in the EU: Germany, France, Italy, Spain, Poland, the Netherlands, Sweden and Belgium.

Amazon has fulfilment centres in these countries:

- Germany

- Spain

- France

- Poland

- Italy

In addition to these countries, Amazon Pan-European FBA sellers can store their inventory in fulfilment centres in:

- The Czech Republic

- Ireland

- Slovakia

- Turkey

Amazon Ireland (Amazon.ie) launched in March 2025 following the opening of a fulfilment centre in Dublin in 2022.

Since the UK is no longer part of the EU, it is no longer eligible for Amazon Pan-European FBA. If you want to sell in the UK, you will need to either ship inventory to fulfilment centres in the UK or use Remote Fulfilment between the UK and the EU.

Amazon has a customer service centre and corporate office in the Netherlands, but shut it’s only warehouse in the country in 2001.

Amazon Pan-European FBA and VAT Compliance

When you join the Pan-EU programme, Amazon will move your stock to their EU fulfilment centres. Except in specific circumstances, the movement of goods you intend to sell across borders is a taxable supply in the EU.

Since the introduction of the One Stop Shop (OSS) and Import One Stop Shop (IOSS) schemes in 2021, your options regarding your VAT obligations have changed. The rules are different depending on whether you are based inside or outside the EU.

Businesses based outside the EU

Being based outside the EU means if you’re selling B2C, Amazon will be the Deemed Supplier, and they will collect and declare the VAT on your behalf.

Businesses Based inside the EU

If you are an EU-established business, you will be responsible for the VAT on sales to private consumers.

Amazon Pan-European FBA works great in tandem with Union OSS if you’re selling B2C. You will apply for the OSS scheme in your home country, and it will cover all your sales across the EU.

If you hold stock in any FBA centre in the EU, you will be required to VAT register in that country to account for the movement of stock between the FBA warehouses. You can get more details about the Deemed Supplier model, OSS and IOSS and the alternatives in our EU VAT for Ecommerce Guide.

Amazon will not be the deemed supplier for B2B sales when the buyer provides a valid EU VAT number, and therefore Amazon will not be responsible for the VAT.

What happens if Amazon Pan-EU FBA sellers don’t register for VAT?

The consequences for VAT non-compliance can be pretty steep:

- Amazon may suspend your account

- Your business may be audited by international tax authorities

- Penalties include fines and backdated payments

Prepare to register for pan-EU FBA

You’ll need to start preparing for sales by applying for your VAT registrations well ahead of time. Individual VAT registrations can take anywhere up to 12 weeks, depending on the country. If you’re planning to register for OSS, it will take a week or two, but first, you’ll have to register for VAT in an EU Member State. Depending on the country that means OSS registration could take up to 14 weeks.

IOSS registrations are in general, much faster. Depending on your circumstances you could be registered in as little as a week.

It’s a good idea to include the cost of compliance in your budgeting. All these registrations cost money, and it’s recommended you get professional help submitting them.

Before you get your VAT number you can’t charge or show VAT on your invoices, but it’s good to know ahead of time what each country’s VAT rates are. You can download our free PDF with all the rates here.

What do I need to do once I’m registered for VAT?

In the EU, VAT is included in the listed price on Amazon for consumer sales, and not added at checkout like US Sales Tax. Once you’re VAT registered, you’ll need to change your prices to include the VAT rate local to your customer.

VAT returns will need to be filed in the frequency required by each tax authority where you are VAT registered.

In respect of OSS and IOSS, OSS is filed quarterly, and IOSS is a monthly submission.

When it comes to paying your VAT, you will save money by using a payment solution such as World First. These services allow you to pay your VAT in the currency local to each tax authority and is often cheaper than doing so through Amazon. We also recommend that you budget for currency fluctuations, so you’re not caught out when markets shift.

Amazon Pan-European FBA Alternatives

If Amazon FBA Europe is too much for your business right now, but you’d still like to expand into Europe, you have a couple of options.

- Amazon’s Multi-Location Inventory (MLI) feature. You can expand to new countries one at a time. This is a lower-cost option and allows you to test your products in new markets gradually. This is also a great option if you know you have a concentration of customers in a specific location.

- The European Fulfilment Network (EFN) allows merchants to sell from one country in the EU to all other EU states. For example, you would hold stock in Germany, and sell to customers across the EU.

- Fulfilled by Merchant is a suite of tools that Amazon offers to help you fulfil your orders. You’ll be able to sell products that don’t qualify for FBA, whilst being able to offer Prime Shipping.