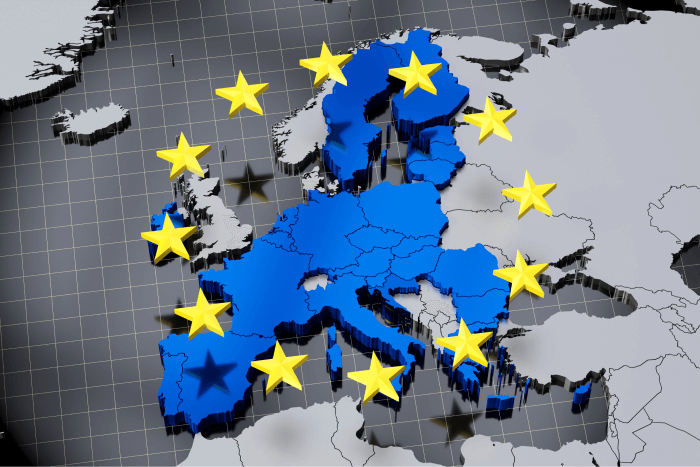

Top 10 Reasons You Should Expand into the EU in 2024

There’s never been a better time to expand into the EU. Europe can provide you with stable and fertile ground to win new customers. The European Union is a prime player in international trade and is one of the world’s most